Do I Pay Vat On Service Charges . — according to uk vat regulations, discretionary service charges are not subject to vat as they are not considered part of the. — small estate management companies will be operating under the vat threshold and hence no vat due on. — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in. What is a sinking fund and how does it work? — vat on service charges for commercial property. If you’re registered for vat, you have to charge vat when you make taxable supplies. — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. What to do about a.

from www.fm.gov.lv

— small estate management companies will be operating under the vat threshold and hence no vat due on. — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. What is a sinking fund and how does it work? What to do about a. If you’re registered for vat, you have to charge vat when you make taxable supplies. — according to uk vat regulations, discretionary service charges are not subject to vat as they are not considered part of the. — vat on service charges for commercial property. — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in.

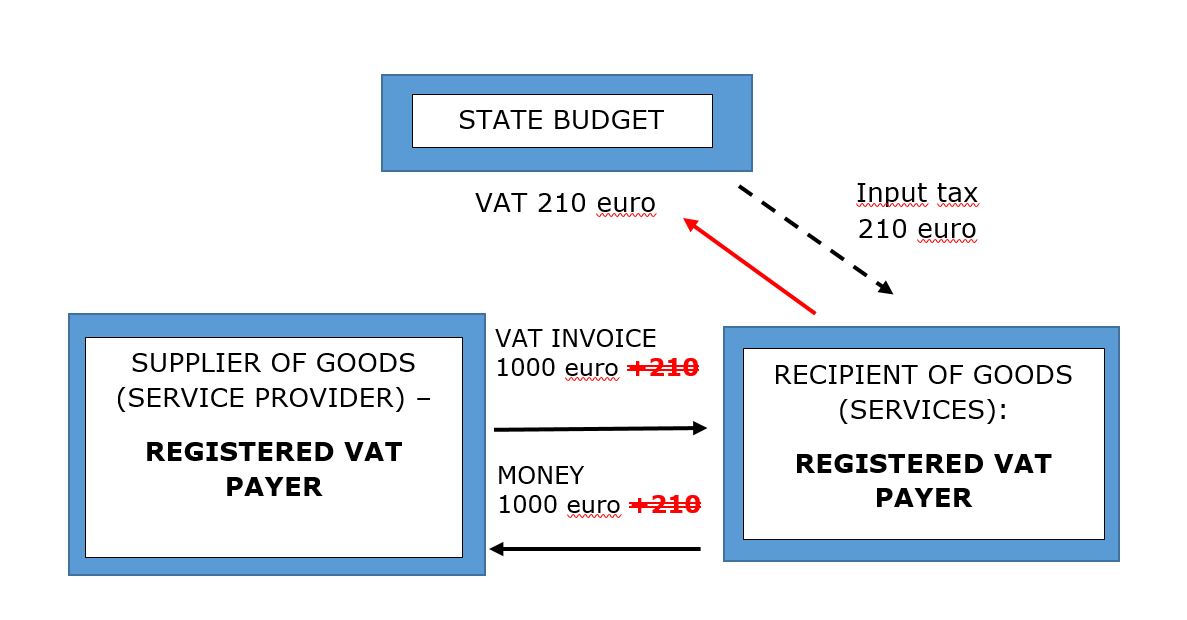

Reverse VAT charge procedure Finanšu ministrija

Do I Pay Vat On Service Charges — vat on service charges for commercial property. — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in. If you’re registered for vat, you have to charge vat when you make taxable supplies. What is a sinking fund and how does it work? — according to uk vat regulations, discretionary service charges are not subject to vat as they are not considered part of the. — vat on service charges for commercial property. — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. — small estate management companies will be operating under the vat threshold and hence no vat due on. What to do about a.

From chacc.co.uk

VAT Accountants VAT Accounting Services for Small Businesses Do I Pay Vat On Service Charges — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. — vat on service charges for commercial property. What is a sinking fund and how does it work? What to do about a. If you’re registered for vat, you have to charge vat when you. Do I Pay Vat On Service Charges.

From pearsonmckinsey.co.uk

VAT Reverse Charge Explained Pearson McKinsey Do I Pay Vat On Service Charges — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in. What is a sinking fund and how does it work? — vat on service charges for commercial property. — according to uk vat regulations, discretionary service charges are not subject to vat as they are. Do I Pay Vat On Service Charges.

From www.tide.co

A guide to domestic VAT reverse charges Tide Business Do I Pay Vat On Service Charges — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in. — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. What is a sinking fund and how does it work? — vat. Do I Pay Vat On Service Charges.

From mblaccounting.co.uk

VAT Services Accountancy Services MBL Accounting Do I Pay Vat On Service Charges — according to uk vat regulations, discretionary service charges are not subject to vat as they are not considered part of the. — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. — vat on service charges for commercial property. What to do about. Do I Pay Vat On Service Charges.

From www.deskera.com

VAT Invoice Definition & Rules for VAT Invoicing Do I Pay Vat On Service Charges — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. — small estate management companies will be operating under the vat threshold and hence no vat due on. — according to uk vat regulations, discretionary service charges are not subject to vat as they. Do I Pay Vat On Service Charges.

From www.tide.co

VAT invoice requirements Tide Business Do I Pay Vat On Service Charges — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. What to do about a. — vat on service charges for commercial property. — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and. Do I Pay Vat On Service Charges.

From www.tide.co

A guide to domestic VAT reverse charges Tide Business Do I Pay Vat On Service Charges What to do about a. What is a sinking fund and how does it work? — small estate management companies will be operating under the vat threshold and hence no vat due on. — according to uk vat regulations, discretionary service charges are not subject to vat as they are not considered part of the. If you’re registered. Do I Pay Vat On Service Charges.

From eq.support.compusoftgroup.com

VAT reverse charge on invoices and credit notes EQ Do I Pay Vat On Service Charges — according to uk vat regulations, discretionary service charges are not subject to vat as they are not considered part of the. — vat on service charges for commercial property. If you’re registered for vat, you have to charge vat when you make taxable supplies. — small estate management companies will be operating under the vat threshold. Do I Pay Vat On Service Charges.

From www.jttaccounts.co.uk

VAT The Domestic Reverse Charge JT Thomas Accountants Do I Pay Vat On Service Charges — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in. What is a sinking fund and how does it work? If you’re registered. Do I Pay Vat On Service Charges.

From sterlinxglobal.com

Do I Have To Pay VAT On Services From The EU? Accountants Liverpool Do I Pay Vat On Service Charges What is a sinking fund and how does it work? — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in. — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. — small. Do I Pay Vat On Service Charges.

From www.streetwisesubbie.com

VAT Reverse Charge For Building And Construction Services Do I Pay Vat On Service Charges — vat on service charges for commercial property. — small estate management companies will be operating under the vat threshold and hence no vat due on. What to do about a. — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in. — thus, an. Do I Pay Vat On Service Charges.

From www.cheltenham-tax-accountants.co.uk

Reverse charge VAT CTA Profit First Accountants Do I Pay Vat On Service Charges What to do about a. — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. If you’re registered for vat, you have to charge vat when you make taxable supplies. — according to uk vat regulations, discretionary service charges are not subject to vat as. Do I Pay Vat On Service Charges.

From freedominnumbers.co.uk

VAT Reverse Charge for Construction All You Need to Know Do I Pay Vat On Service Charges What is a sinking fund and how does it work? — small estate management companies will be operating under the vat threshold and hence no vat due on. — vat on service charges for commercial property. If you’re registered for vat, you have to charge vat when you make taxable supplies. What to do about a. —. Do I Pay Vat On Service Charges.

From www.mitchellsaccountants.co.uk

VAT Reverse Charge for Construction Services Mitchells Do I Pay Vat On Service Charges — vat on service charges for commercial property. — according to uk vat regulations, discretionary service charges are not subject to vat as they are not considered part of the. What is a sinking fund and how does it work? — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas. Do I Pay Vat On Service Charges.

From help.invoicing-software.com

UK HMRC VAT Reverse Charge Support SliQ Invoicing Online Help Do I Pay Vat On Service Charges — according to uk vat regulations, discretionary service charges are not subject to vat as they are not considered part of the. — vat on service charges for commercial property. — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of their residential lease. — service charges. Do I Pay Vat On Service Charges.

From www.rousepartners.co.uk

Construction VAT Reverse Charge What are the new rules? Rouse Do I Pay Vat On Service Charges — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in. — small estate management companies will be operating under the vat threshold and hence no vat due on. If you’re registered for vat, you have to charge vat when you make taxable supplies. — vat. Do I Pay Vat On Service Charges.

From pearsonmckinsey.co.uk

Frequently Asked Questions on the VAT Reverse Charge for Construction Do I Pay Vat On Service Charges — service charges are often payable to the landlord under a lease or licence, in the same way as rent, and in. — small estate management companies will be operating under the vat threshold and hence no vat due on. What is a sinking fund and how does it work? — according to uk vat regulations, discretionary. Do I Pay Vat On Service Charges.

From support.cfp-software.co.uk

How can I charge VAT on Service charges? CFPwinMan Do I Pay Vat On Service Charges If you’re registered for vat, you have to charge vat when you make taxable supplies. What to do about a. What is a sinking fund and how does it work? — vat on service charges for commercial property. — thus, an obligation on a leasehold tenant to pay a service charge to maintain communal areas in respect of. Do I Pay Vat On Service Charges.